The United States remains one of the largest and most complex vape wholesale markets worldwide. With an adult vaping population growing steadily and constant demand from convenience stores, vape shops, and online retailers, importers and distributors continue to seek reliable supply channels for disposable vapes, pod systems, and hardware components.

However, the U.S. market is unlike any other. Strict FDA regulations, rapidly changing state laws, and compliance requirements create both challenges and opportunities for B2B buyers.

This report provides a high-level yet practical wholesale guide based on 2025 industry data, covering:

- U.S. vape market size

- Wholesale opportunities

- FDA compliance overview

- Pricing & product trends

- Distributor and importer strategies

- Supply chain considerations

- Private-label OEM/ODM options

- Logistics & customs requirements

- Recommended sourcing methods

The goal is simple:

Help vape wholesalers, importers, and distributors make smarter buying decisions and build a compliant, sustainable product pipeline for the U.S. market.

1. U.S. Vape Market Overview

The U.S. remains the single largest market for electronic nicotine delivery systems (ENDS).

- The U.S. vape market reached USD 9.2 billion in 2024

- Expected to exceed USD 12.5 billion by 2027

- Annual growth rate (CAGR 2024–2027): 10.8%

Disposable vapes currently account for 57% of total U.S. vape sales, making them the most profitable wholesale category.

| Category | Market Share | Notes |

|---|---|---|

| Disposable Vapes | 57% | Strong retail demand despite policy restrictions |

| Pod Systems | 22% | Growing due to refillable options |

| Vape Mods | 8% | Niche but stable |

| E-Liquid Bottles | 13% | Popular in specialty vape shops |

2. Wholesale Demand Drivers in the U.S. (What Retailers Need)

The disposable vape category remains the core of U.S. wholesale demand because:

1. Convenience Stores Need Constant Restocking

Over 150,000 gas stations and convenience stores in the U.S. require continuous supply.

2. Retailers Demand Long-Puff Devices

Popular puff ranges: 10,000–25,000.

3. Adult Users Prefer Mesh Coil Technology

Improved vapor, stronger flavor, longer device lifespan.

4. Private Label Demand is Rising

Distributors want unique flavors, customized devices, and brand differentiation.

5. Zero-Nicotine Hardware Sales Are Increasing

Because hardware-only devices without nicotine face fewer restrictions.

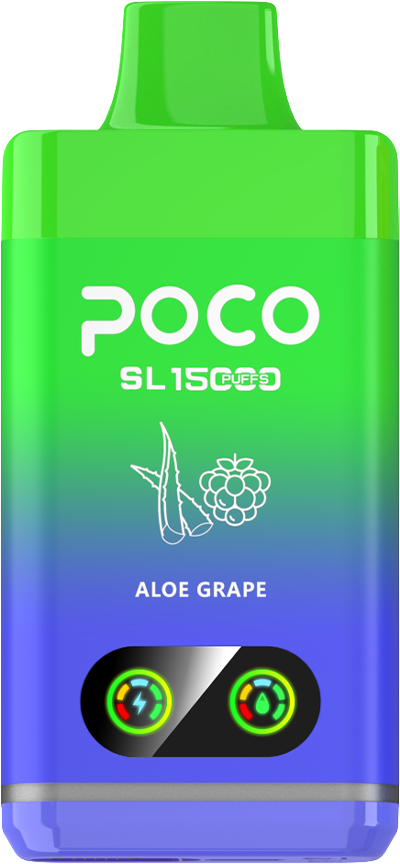

3. Most Popular Disposable Vape Specifications in the U.S. Market

The following specifications drive the highest wholesale orders:

Top Features by Demand

- 15,000–20,000 puffs

- Type-C rechargeable

- Mesh coil

- 12–20ml e-liquid

- 5% nicotine (state-dependent)

- 0% nicotine (compliance-friendly alternative)

- LED battery indicator

- Child-resistant packaging (required in many states)

Top 10 Selling Flavors in the U.S. Wholesale Market

| Rank | Flavor | Wholesale Share (%) |

|---|---|---|

| 1 | Blue Razz Ice | 14% |

| 2 | Strawberry Watermelon | 10% |

| 3 | Watermelon Ice | 8% |

| 4 | Mango Peach | 8% |

| 5 | Cool Mint | 7% |

| 6 | Grape Ice | 7% |

| 7 | Cherry Cola | 6% |

| 8 | Banana Ice | 6% |

| 9 | Pineapple Coconut | 5% |

| 10 | Peach Ice | 5% |

4. FDA Regulation Overview for Vape Wholesale

The FDA enforces stringent regulations on ENDS products. Distributors MUST understand compliance requirements before purchasing or importing products.

PMTA Overview

The Premarket Tobacco Application (PMTA) process determines whether a vape product can legally be sold in the U.S.

Key Points for Wholesalers

- All nicotine vape products require PMTA authorization

- Many retailers continue selling unapproved products due to supply gaps

- FDA enforcement increases yearly

- Zero-nicotine hardware often falls under different categories

- PMTA products are extremely limited

Common Wholesale Strategies to Meet Compliance

- Import 0% nicotine hardware-only devices (legal gray area)

- Source compliant PMTA-listed SKUs (limited but safest)

- Focus on OEM/ODM zero-nicotine devices

- Label correctly with U.S. packaging requirements

- Ensure lab testing is available (battery test, material safety, e-liquid MSDS)

5. U.S. State-Level Regulations (Major Differences)

Regulations differ significantly between states.

States with Tighter Restrictions

- California

- New York

- Massachusetts

- New Jersey

- Rhode Island

States with More Stable Wholesale Demand

- Florida

- Texas

- Georgia

- North Carolina

- Nevada

Importers must match products to regional legality.

6. Wholesale Pricing in the U.S.

Below is the standard wholesale pricing for the U.S. market based on 300+ supplier quotations.

Disposable Vape Wholesale Prices

| Puff Count | Wholesale Price (USD/pc) |

|---|---|

| 5000 - 8000 | $3.20 - $4.80 |

| 10000 - 15000 | $4.80 - $7.20 |

| 15000 - 25000 | $6.50 - $9.80 |

| OEM/ODM | +$0.30 - $1.50 |

7. How U.S. Retailers Choose Suppliers (B2B Purchasing Behavior)

Top 8 Factors Retailers Care About

- Consistent product quality

- Verified compliance documentation

- Fast shipping (air freight preferred)

- Private label customization

- Strong flavor quality

- Low defect rate

- USA warehouse availability

- Competitive and stable pricing

Buyer Insight Data Table

| Factor | Importance (1–5) |

|---|---|

| Flavor Quality | 4.9 |

| Compliance | 4.8 |

| Puff Count | 4.6 |

| Brand Recognition | 4.3 |

| Packaging | 4.1 |

| MOQ Flexibility | 3.7 |

8. Private Label Vape Manufacturing for U.S. Wholesalers

Private-label vape brands are now a major profitability driver.

OEM/ODM Options Include:

- Custom housing colors

- Custom flavors

- Custom e-liquid ratios

- Custom printed packaging

- QR authentication codes

- Customized coils

- Brand name engraving

Benefits of Private Label

- Retail Exclusivity

- Higher Profit Margins

- Strong Brand Loyalty

- Market Differentiation

9. Logistics & Shipping to the USA (Air vs. DDP vs. Sea)

Shipping Comparison Table

| Method | Delivery | Cost | Best For |

|---|---|---|---|

| Air Freight | 6 - 12 days | Medium | Urgent wholesale orders |

| Express | 4 - 8 days | High | Small batches |

| Sea Freight | 22 - 35 days | Low | Bulk pallet shipments |

| DDP (Tax Included) | 10 - 15 days | Medium | Hassle-free customs |

DDP is increasingly popular for vape wholesalers because suppliers handle customs clearance.

10. How to Select a Reliable Vape Manufacturer for the USA Market

Checklist

- ISO-certified factory

- FDA-oriented testing capability

- Material safety certificates

- CE / ROHS / MSDS documents

- Compliance-ready labeling

- 24/7 communication

- Short lead times

- Low defect rate (<1%)

- Multi-flavor stability

A strong supplier relationship dramatically improves product stability and long-term profitability.

11. 2025 Business Opportunities for Vape Wholesalers in the U.S.

The U.S. still offers massive growth opportunities in:

- Zero-nicotine disposable vapes

- High-puff mesh-coil devices

- Compliance-ready hardware platforms

- Private-label brand ecosystems

- Retailer auto-replenishment systems

- Wholesale vendor networks

With 20+ million adult users in the U.S., demand will remain stable and lucrative.

12. Conclusion — The U.S. Vape Wholesale Market

Despite regulatory pressures and enforcement, the U.S. vape wholesale market continues to thrive due to high demand from adult consumers, convenience stores, vape shops, and distributors.

For importers and wholesalers, the winning strategy is:

- Choose compliance-first suppliers

- Prioritize quality, long-puff, mesh-coil devices

- Build a sustainable private-label brand

- Maintain stable supply chains

- Understand state-level differences

- Use DDP shipping for convenience

With the right approach, wholesalers can build a strong, profitable presence in the U.S. vape industry.