Germany is one of Europe's most influential and fastest-growing electronic cigarette markets. With nearly 84 million residents, high smoking rates compared to Western European averages, increasing harm-reduction awareness, and a mature retail ecosystem, the German vape industry presents tremendous commercial potential for both B2B and B2C sectors.

Overview of Germany's Vape Market Growth

Germany's vaping industry has grown steadily over the past decade due to increasing adoption among adult smokers seeking alternatives to traditional tobacco. The country now ranks top 3 in Europe for vape consumption, alongside the UK and France.

Key Insights from Industry Sources (2024 – 2025):

- Germany has over 2.1 million active vapers, according to the German Vaping Association (BfTG).

- The vape market value exceeded €900 million in 2024, projected to reach €1.3 billion by 2026.

- Disposable vapes represent 48–52% of total retail sales, showing the strongest growth momentum.

- Germany has one of Europe's highest adult smoking rates at 28–30%, meaning a large potential customer base for vaping products.

The combination of rising demand, evolving product innovation, and growing preference for convenience positions Germany as a major global vape market.

Germany's Consumer Demand for Vapes: What Drives Growth?

Germany's vape market demand is shaped by several interconnected factors.

1. High Smoking Rates Increase Vape Conversion

Germany's adult smoking rate is significantly higher than many EU nations. With more smokers looking for reduced-risk alternatives, conversion to vaping has accelerated.

| Country | Adult Smoking Rate (2024) | Impact on Vape Demand |

|---|---|---|

| Germany | 28 – 30% | Very High |

| UK | 13 – 14% | Moderate |

| France | 25 – 26% | High |

| Netherlands | 19 – 20% | Medium |

Germany's larger base of traditional smokers creates consistent demand for:

- Disposable vapes

- Nicotine salt e-liquids

- Tobacco-flavored and menthol-based devices

- Entry-level pod systems

This migration trend is estimated to grow 6–9% annually through 2026.

2. Increasing Acceptance of Vaping as Harm Reduction

German public health agencies generally promote medically verified harm-reduction models, acknowledging that vaping poses fewer harmful chemicals than traditional smoking.

While the government remains cautious, the public increasingly views vaping as:

- A less harmful alternative

- A more socially acceptable option

- A cleaner and odor-free lifestyle product

This benefits the market by reducing stigma and easing new user adoption.

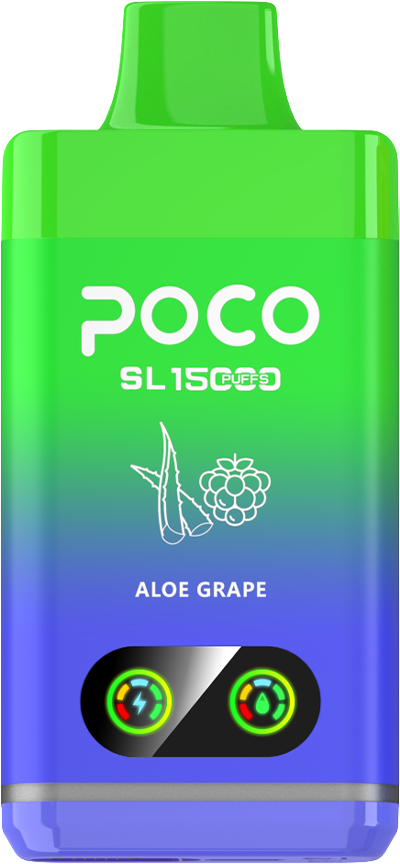

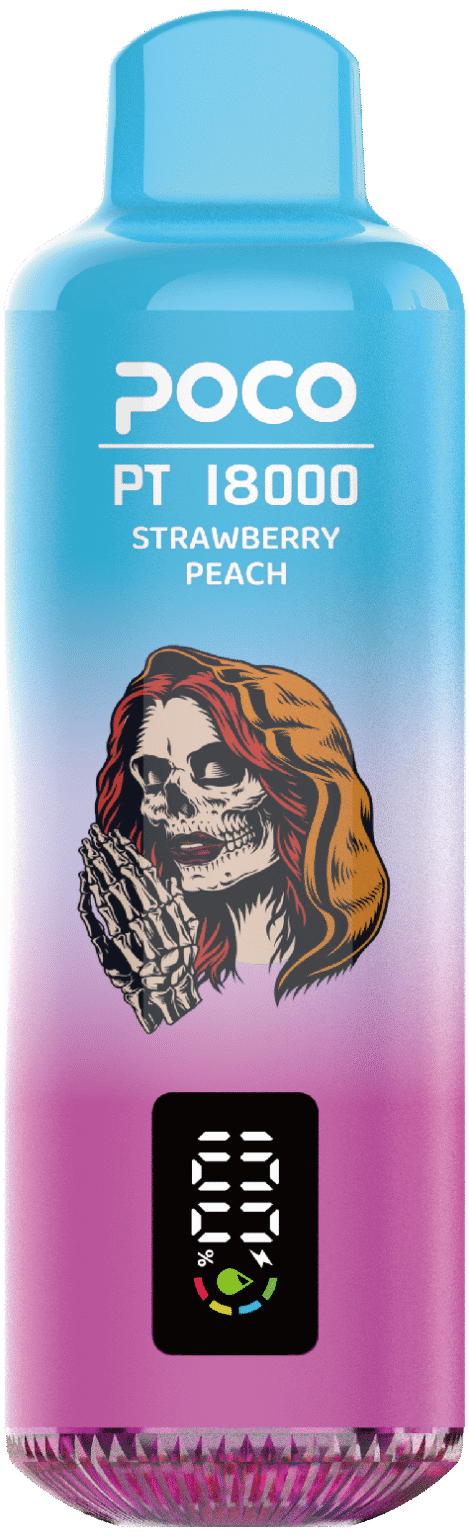

3. Rapid Expansion of Disposable Vapes

Disposable vapes have completely reshaped demand in Germany since 2022.

Why Germans Prefer Disposable Vapes:

- No charging

- No refilling

- Strong flavors

- Lightweight and pocket-friendly

- Affordable entry price (€9–€15)

- Mesh coil flavor consistency

- Nicotine salt delivering smoother hits

Most Popular Puff Ranges in Germany (2025):

| Puff Range | Demand Level |

|---|---|

| 1500 – 3000 puffs | Low |

| 4000 – 5000 puffs | Medium |

| 6000 – 10000 puffs | Very High |

| 12000+ puffs | Growing |

The German market particularly favors long-lasting 6000–10000 puff models with rechargeable batteries.

4. Nicotine Preferences in Germany

German adult users show distinct nicotine patterns.

Nicotine Strength Preferences (2025 Estimate):

| Nicotine Level | Market Share |

|---|---|

| 20 mg (2%) | 55% |

| 10 mg (1%) | 20% |

| 0 mg | 10% |

| >20 mg (illegal in EU) | 0% |

Because Germany is under EU TPD regulation, disposables sold legally are capped at:

- 2% (20 mg/ml) nicotine

- 2 ml e-liquid capacity

However, actual market reality shows strong demand for higher-capacity devices imported by wholesalers, which refill automatically or are categorized as "rechargeable disposables", thereby bypassing TPD prefilled limits.

This creates a significant wholesale opportunity.

Market Segmentation: Who Buys Vapes in Germany?

A. Young Adult Consumers (19 - 28 Years Old)

Key characteristics:

- Prefer fruity & iced flavors

- Fans of long-lasting disposables

- Shop online & via convenience stores

- Influenced by social media (Instagram / TikTok)

- High product trial rate

This group represents 40-45% of Germany's vape demand.

B. Adult Smokers Seeking Alternatives (30 - 55 Years Old)

Key characteristics:

- Prefer tobacco, menthol, mint

- Choose dependable coil systems

- Less sensitive to price

- Value battery stability and throat hit

This group is crucial for:

- Pod systems

- Nicotine salt cartridges

- Tobacco-flavored disposables

C. Heavy Smokers Switching to High-Puff Devices

This segment drives the premium disposable category with:

- 6000-15000 puff devices

- Mesh-coil devices

- 2-5 day durability

- Rechargeable battery formats

These buyers prioritize flavor consistency and device reliability.

Top-Selling Vape Product Categories in Germany (2025)

| Category | Market Share | Growth Trend |

|---|---|---|

| Disposable Vapes | 48-52% | Strong |

| Pod Systems | 28-30% | Stable |

| Mods & Tanks | 10-12% | Declining |

| E-Liquids | 8-10% | Moderate |

| Nicotine-Free Vapes | 4-6% | Increasing |

| CBD/Herbal Vapes | 2-3% | Slow |

Disposables continue to dominate, driven by ease of use and expanding consumer acceptance.

Flavor Demand Trends in Germany

Most Popular Flavors in 2025

| Flavor Profile | Example Flavors | Demand Level |

|---|---|---|

| Fruity (Top Trend) | Watermelon Ice, Blueberry, Peach | Very High |

| Mixed Fruit | Kiwi Passionfruit, Mango Peach | High |

| Menthol/Mint | Cool Mint, Ice Menthol | High |

| Tobacco | Classic Tobacco, Golden Tobacco | Medium |

| Sweet/Dessert | Grape, Cola, Creamy flavors | Medium |

| Non-Sweet | Herbal, neutral mint | Growing |

Notably, Germany prefers fresh, fruity, ice-based flavors more than many European markets.

How Regulation Influences Vape Market Demand in Germany

Germany follows EU's Tobacco Products Directive (TPD), meaning:

- 2% max nicotine strength

- 2ml max tank capacity for prefilled vapes

- Strict labeling and packaging rules

- ID verification for online orders

- Advertising restrictions

However:

The German Market Still Has Strong Demand for High-Puff Devices

Why?

Because:

- They are rechargeable

- They contain larger e-liquid volumes but are refilled through separate containers

- Many wholesalers import from China and distribute through retail shops

- Enforcement in retail environments varies by region

This creates a gray-zone opportunity for manufacturers and importers.

Wholesale & B2B Demand for Vapes in Germany

Germany has one of Europe's most active wholesale ecosystems for vapes.

Why Germany Is a Strong Wholesale Market

- Thousands of vape shops & kiosks

- Rising demand for high-puff disposables

- Strong distributor network

- Acceptance of Chinese OEM/ODM brands

- High reorder frequency

- Strong demand for flavor variety

Most Sought-After Wholesale Products:

- 6000-15000 puff disposable vapes

- Mesh coil disposable vapes

- 2% nicotine salt formulations

- Rechargeable battery disposables

- Tobacco & menthol flavors

- TPD-compliant 2ml pod devices

Data Table: Germany Vape Market at a Glance (2025)

| Category | Data (2025) |

|---|---|

| Active Vapers | 2.1M - 2.4M |

| Market Value | €900M - €1.1B |

| Annual Growth | 7 - 12% |

| Disposable Market Share | 48 - 52% |

| Average Disposable Price | €9 - €15 |

| Top Nicotine Strength | 20 mg |

| Popular Puff Range | 6000 - 10000 puffs |

| Online Purchase Share | 40 - 45% |

| Retail Purchase Share | 55 - 60% |

Distribution Channels in Germany

1. Vape Shops

Germany has over 3,000 specialized vape stores.

2. Convenience Stores & Kiosks

One of the biggest drivers of disposable vape sales.

3. Online Stores

Popular due to product variety and privacy.

4. Wholesalers & Importers

Directly import from China, dominating the high-puff segment.

References

- Germany Federal Center for Health - https://www.bzga.de

- European TPD Regulation Details - https://ec.europa.eu

- WHO Tobacco Harm Reduction - https://www.who.int

- German Vaping Association (BfTG) - https://www.bftg.info

Wholesale Disposable Vapes - https://feemovape.com/wholesale-disposable-vapes

Compare Vape Models - https://feemovape.com/vape-comparison

German TPD Compliance Guide - https://feemovape.com/germany-vape-regulations

High-Puff Disposable Selection - https://feemovape.com/high-puff-vapes

Future Market Outlook: Will Germany's Vape Demand Grow Further?

Based on current trends, Germany's vape market demand is expected to continue rising through 2026 due to:

- Continuous conversion from smoking

- Increasing acceptance of vaping

- Innovation in high-puff disposable devices

- Broader wholesale availability

- Expanding online sales

- Consumers prioritizing convenience & flavor experience

Projected market size by 2026: €1.3-€1.5 billion.

Conclusion: Germany's Vape Demand Is Strong and Growing

The German vape industry represents a massive opportunity for brands, wholesalers, and distributors. With strong consumer demand, a large smoking population transitioning to vaping, rising disposable vape popularity, and a robust wholesale network, Germany remains one of Europe's most profitable electronic cigarette markets.

Brands entering the German market should prioritize:

- Long-lasting disposables

- Strong flavor profiles

- TPD compliance

- Rechargeable designs

- Reliable supply chains

- Competitive wholesale pricing

With the right product and distribution approach, Germany offers exceptional growth potential in 2025 and beyond.